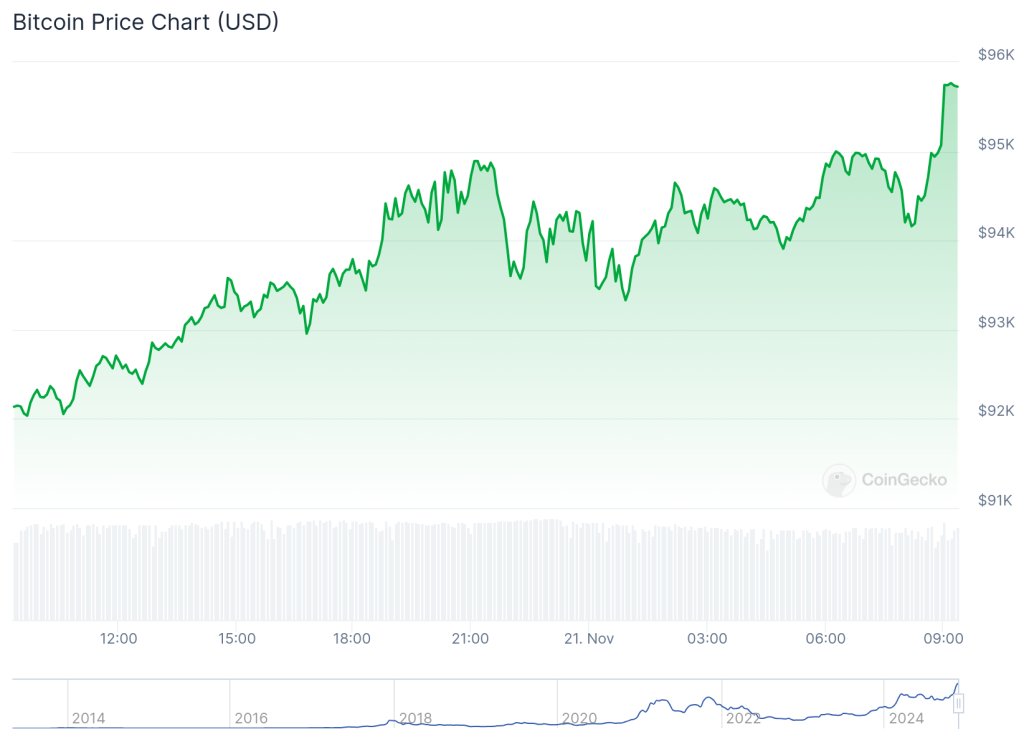

Bitcoin reached a new high of $95,000 during the early Asian trading hours on Thursday, 21 November 2024. According to Coingecko, Bitcoin is currently trading at over $95,700 as of the writing. This marks a 125% increase for the top cryptocurrency by 2024.

The total market capitalization of memes fell 4.9% over the past 24 hours despite a rise in the price of the top cryptocurrency.

The Trump Team is Considering White House Crypto Policy

As previously reported, Donald Trump’s campaign team is exploring the possibility of a White House position dedicated to crypto policy. The team is screening candidates because Trump, who was a crypto enthusiast during his campaign, promised to fire SEC chair Gary Gensler on the first day of his presidency. It would be the very first crypto-specific White House position and a major milestone for the growing mainstream presence of the industry.

Bitcoin Price: From $75,000 to $95,000 within Two Weeks

Bitcoin’s initial rapid rise was fueled by the combined impact of Trump winning and the Federal Reserve’s 25-basis point rate cut.

Bitcoin was trading at around $68,000 before the US election. After Trump’s win, the digital currency began a rapid rise, breaking multiple resistance levels.

In only two weeks it reached $95,000 and then $80,000, $85,000 and finally $90,000.

Crypto commentator BitQuant predicted this bullish trajectory months before.

In a post on X dated May 15, he confidently declared, “$95K can be achieved with just one move. That is obvious.”

This prediction proved remarkably accurate, with Bitcoin surging from approximately $68,000 in a mere fortnight.

BitQuant’s forecast stemmed from an analysis by fellow commentator Mikybull Crypto, who identified a “cup and handle” formation on weekly timeframes.

This pattern, characterized by a consolidation period after a significant uptrend, a reversal, and a subsequent breakout, signaled a potential return to price discovery for Bitcoin.

Mikybull Crypto anticipated an “explosive” breakout, propelling the Bitcoin price toward a new cycle peak.

Trump’s Pro-Crypto Stance and Bitcoin Price Implications

President-elect Donald Trump has continued to show support for cryptocurrencies. Reports indicate that Trump Media & Technology (DJT) is nearing a deal to acquire the crypto trading platform Bakkt.

Adding to these developments, Trump met with Coinbase CEO Brian Armstrong on Tuesday.

While the specifics of their discussion remain undisclosed, the meeting occurred as Trump finalises his cabinet appointments.

During his campaign, Trump expressed his intent to create a presidential advisory council on Bitcoin and crypto to develop industry regulations.

Coinbase CEO Brian Armstrong publicly endorsed Hester P. Peirce as the new leader of the SEC. Trump appointed her.

The Wall Street Journal reported that Coinbase donated over $100 million to Political Action Committees during the 2016 election cycle.

Most of these funds were allocated to Fairshake. This crypto-focused PAC spent more than 40 million dollars to support congressional candidates.

Bitcoin Price and MicroStrategy Bullish Outlook

Michael Saylor, the billionaire executive chairman of MicroStrategy, is a steadfast bull on cryptocurrency.

MicroStrategy purchased an additional $4.6 billion of Bitcoin last week. Saylor led the company to double its initial $250 million Bitcoin purchase in 2020, resulting in 279,420 Bitcoins on November 10, 2024. This represents a total price of $ 11.9 billion and a market worth of $ 24.5 billion.

MicroStrategy’s Bitcoin holdings are now equivalent to about one-third the $73.3 billion enterprise valuation of the company and approximately 1.4% of Bitcoin’s $2.2 trillion in market capitalization.

Saylor predicts a Bitcoin price of $100,000 by 2024. could see a long-term rise to $13,000,000 in the next 21 years.

This ambitious prediction implies a gain of nearly 15,000% from the current Bitcoin value.

In an interview with CNBC, Saylor predicted that Bitcoin would eventually grow from 0.1% of global capital to 7%, due to increased adoption by financial institution.

Bitcoin will also surpass the S&P 500 trading volume. Its open, global and unrestricted capital markets approach will attract investors.