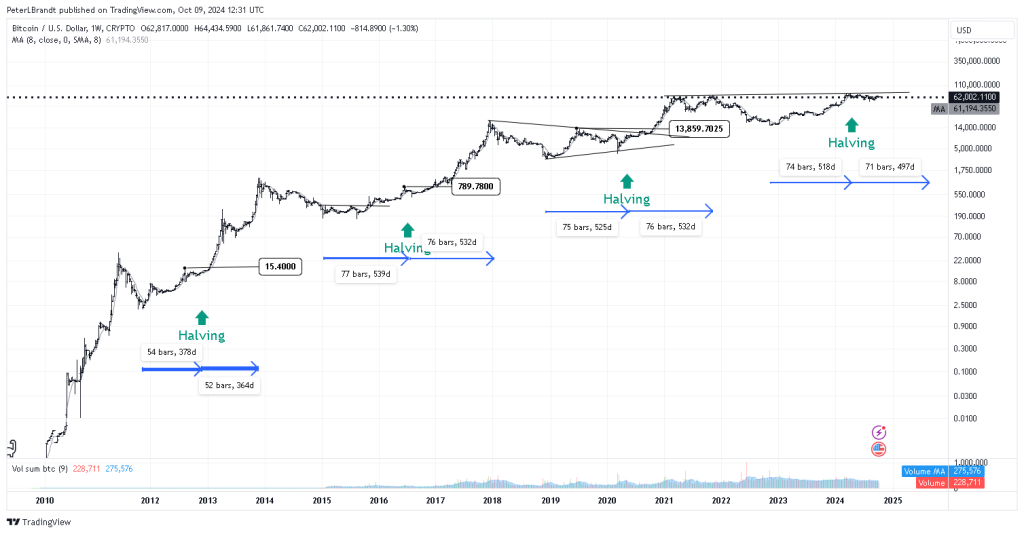

In a post on October 9, Brandt shared his Bitcoin expectations through 2025. He referred to the recent market consolidation as a brief pause, with the bulk bull market yet ahead.

This forecast is based on past halving cycles. Data from the past shows that the second half of Bitcoin’s 4-year halving cycle always results in the highest price increase. Brandt’s macro-stance sets Bitcoin at $135,000 in August or September 2025.

There is one caveat, however: If the bears take control and Bitcoin has a major decline, then $48,000 will be the level that determines whether the prediction succeeds or fails.

Brandt confirms that “close below $48k negates my chart analyses.”

Bitcoin 10x Research Cautions

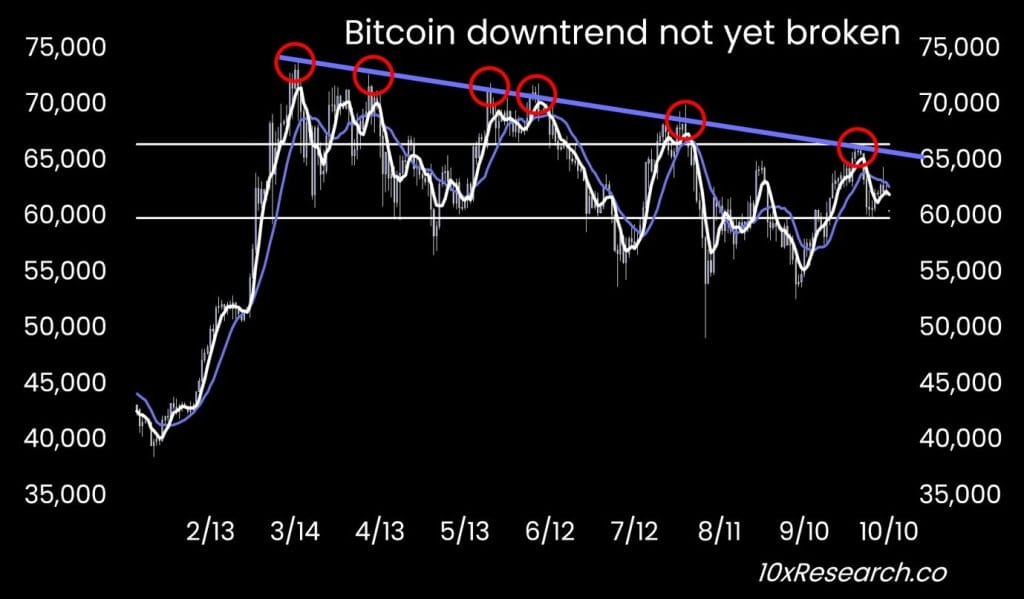

10x Research’s CEO Markus Theilin warned that macro trends are “overly simple and insufficient” for predicting the direction of the market.

He noted that Bitcoin maximalists often expect the price of Bitcoin to “infinitely increase” after the halving, and that it will rise exponentially when the “bottoming-out of the liquidity circle is marked by Fed rate reductions and increasing money supply.”

Theilin stresses that while these macro-factors are undoubtedly positive, they must be backed by strong fundamentals.

Bitcoin’s downtrend continues months after the last halving, proving that this is a necessity. ‘s narrative of a soft landing in the US economy is becoming more plausible after September’s aggressive Fed interest rate cut.

The report claims that the current market is suffering from a lack a compelling momentum. The report argues that “macro-factors can set the course, but the ship will not stay on track without enough wind.”

The US Election Plays a Key Role

Theilin said that the November 5th U.S. Presidential election could be a catalyst for Bitcoin to gain the “wind” needed for a breakthrough.

Trump’s victory is seen as favorable to cryptocurrencies. This is especially true given his involvement with Bitcoin 2024, and his announcements about a Decentralized Finance (DeFi) Project called World Liberty Financial.

Analysts predict that a Trump presidency would accelerate the development of crypto-friendly policies. Standard Chartered’s past reports have projected a more conservative Bitcoin price of $220K during a Trump presidency.

The report also highlighted that a Harris presidency could push Bitcoin to new levels, with a $75,000 target, particularly after her public endorsement of digital currencies.

It warned that the initial price drop could be due to her election. Investors will likely buy dips, as they recognize that regulatory progress will continue.

Theilin concluded by expressing optimism and stating that it was “too soon” to give up on hopes of a rally in Q4. He did stress that risk management was “crucial.”