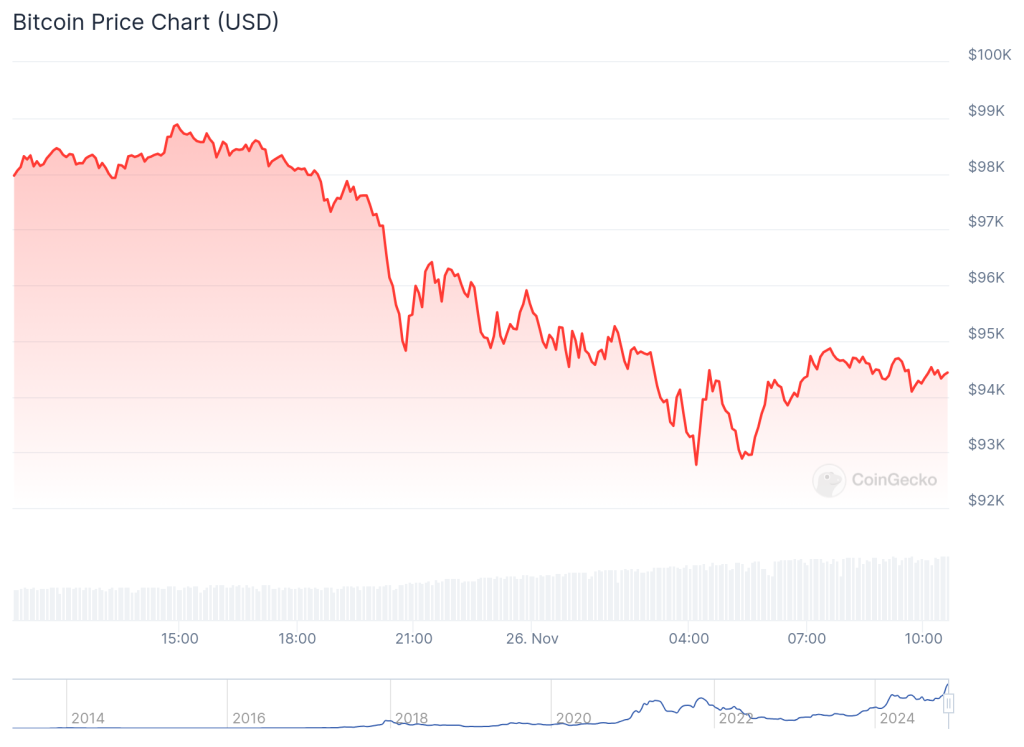

Bitcoin, the leading cryptocurrency, has recently experienced its longest losing streak during the current rally, which began earlier this month following Donald Trump’s election win. Despite its attempt to reach the $100,000 milestone, Bitcoin faced a sharp fall, dropping below $93,000 with a 5% decline over 24 hours.

However, the digital asset quickly rebounded, trading above $94,200 during early Asian trading hours on Tuesday. The broader cryptocurrency market also faced turbulence, recording a 3.8% dip over the same period, underscoring the sector’s ongoing volatility.

Long-term Bitcoin holders are cashing out

Many long-term holders were chasing their gains as Bitcoin reached all-time highs over the course of the month. Galassnode Data shows that the pressure to sell has been highest since April 2024, when long-term holders took profits. Long-term holders who have held their coins for 6-12 months led the selling activity. They averaged 25.6K BTC in profit per day, and most recent sales came from this group.

Holders of Bitcoin with a 6-12 month holding period spent on average BTC at 71% less than the current market price, which is around $57.9K. They took advantage of the recent rally in Bitcoin’s value from $74K up to $99K.

Spot Bitcoin ETFs continue to absorb selling pressure

Over the past few weeks, spot Bitcoin ETFs have taken on the pressure of long-term investors to sell. Following the US election, more than $7 billion has been invested in US exchange-traded funds for Bitcoin, bringing their total assets to more than $105 billion.

The US Bitcoin spot ETFs experienced a net outflow on November 25 of $438,000,000, with Bitwise’s spot Bitcoin ETF leading with negative $280,000,000. BlackRock’s IBIT experienced a net inflow on the same date of $267m, according to data.